salt tax cap repeal 2021

Full repeal would be expensive opposed by progressives. The budget blueprint Democrats passed this summer instructs lawmakers to include some form of SALT cap relief in a tax-and-spend plan of up to 35 trillion.

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

It would reduce their 2021 taxes by an average of only 20.

. Trumps main domestic achievement. See what other deductions changed in 2018 How to. Four blue states misguided legal challenge to the cap on the SALT tax deduction suffered a well-deserved defeat in the Second Circuit.

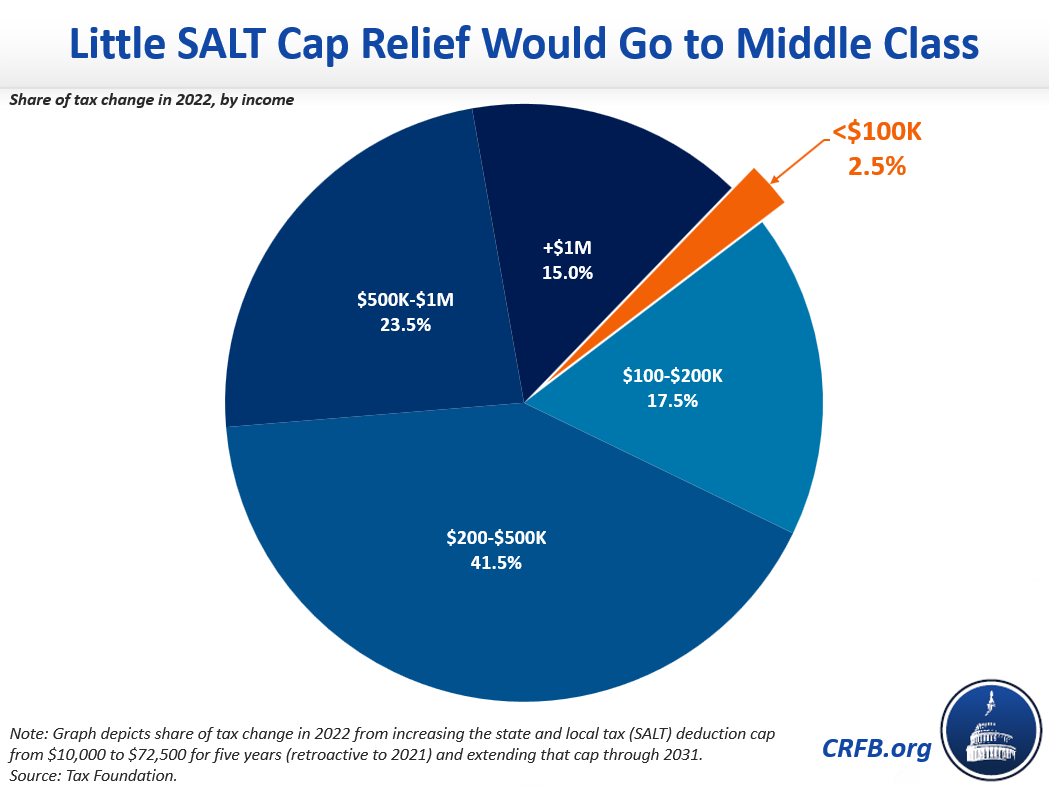

31 2021 depending on the state PTE regime in order to benefit from the SALT cap deduction in 2021 Many firms are advising clients to pay the tax by year end to be on the safe side and comply with the four corners of the notice Scott said. NEW YORK CBSNewYork -- Tri-State Area homeowners could get a welcomed tax. Certain members of the House and Senate want the SALT deduction cap removed which would benefit primarily higher earnersand result in a 380 billion reduction of federal revenue.

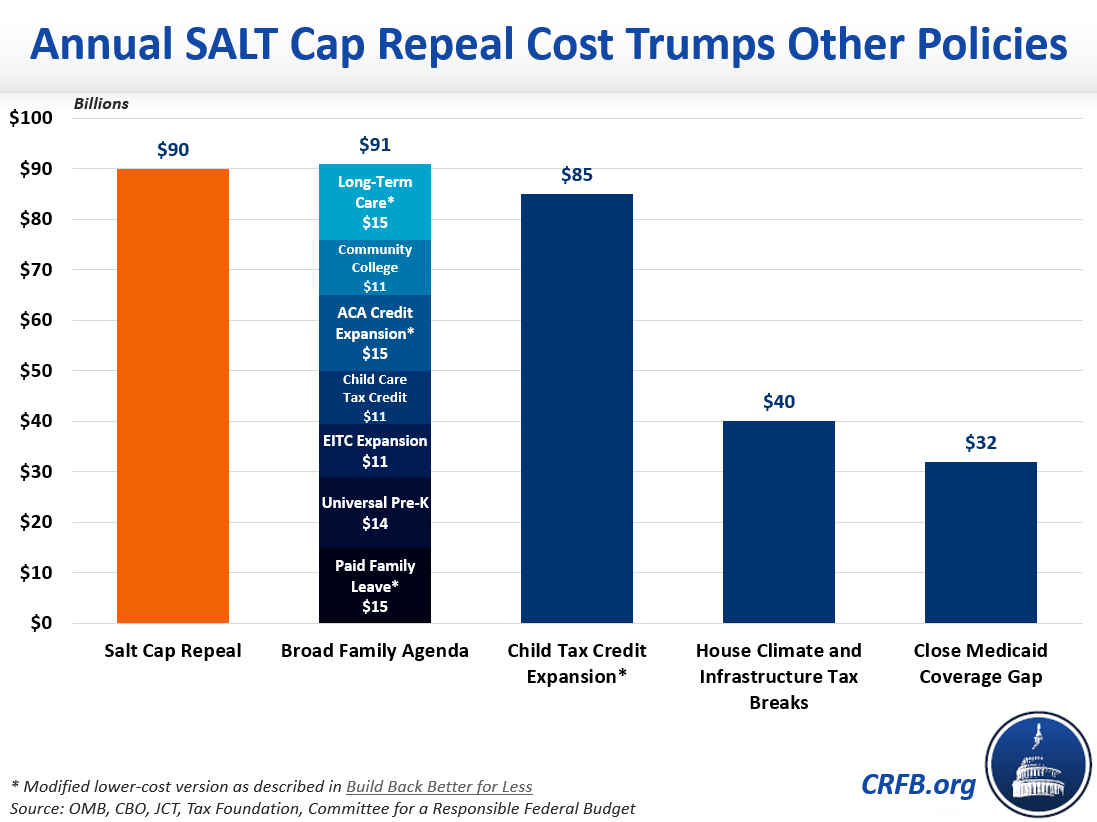

9 2021 558 PM. A plan to give a tax benefit to affluent New Yorkers and Californians isnt something most of the party wants but that US. Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent.

According to a committee aide a proposal on the table would repeal the 10000 cap for the 2021 through 2025 tax years. Nov 19 2021 Taxes. The prudent course does appear to be to properly elect if applicable and pay by Dec.

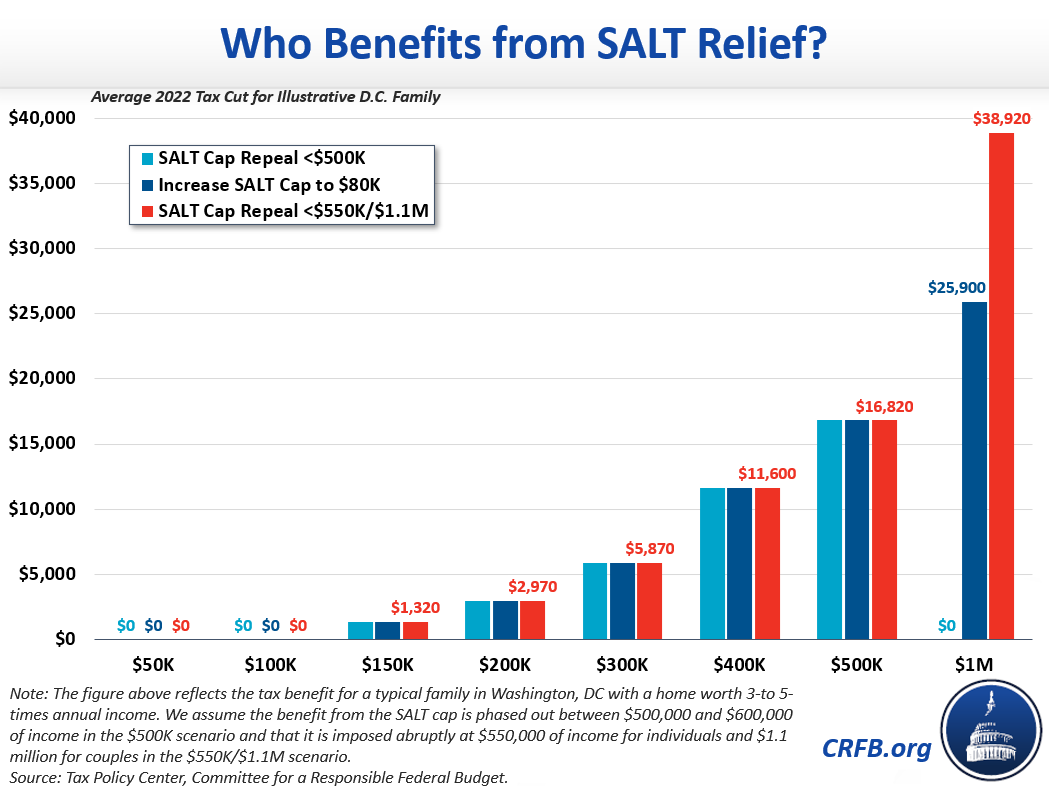

As alternatives to a full repeal of the cap lawmakers and experts have proposed a. To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households making below 900000 or 950000 per year. For 2021 the standard deductions are 12550 for single filers or 25100 for married couples filing together meaning they wont itemize if write-offs including SALT medical expenses.

Cuomo Murphy Demand Repeal Of Federal Cap On State And Local Tax Deduction. That figure dropped to 21 billion in 2020. Democrats in New York New Jersey and California have led a fight for years to repeal the so-called SALT cap which since 2017 has limited the federal income-tax deduction for state and local.

Many Democrats have pushed to repeal. Expansion of SALT Cap Workaround SB 113 expands the SALT cap workaround by allowing the credit for taxes paid by the entity to offset the California tentative minimum tax of 7 percent of taxable income for tax years beginning on. The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017.

The deduction was unlimited before 2018. A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. Americans with six-figure salaries and high property and state income tax bills will see the most noticeable effects from lifting the 10000 SALT cap according to an analysis by accounting firm.

February 5 2021 541 PM CBS New York. This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress doesnt remove the cap in its spending bill. Joe Manchin D-WVa raised broader objections to President Bidens social spending and climate package.

This would be in place of the House plan to lift the cap to 80000 through 2030 and reinstate it at 10000 for 2031. The early repeal of the NOL suspension and business credit limits comes amid strong tax revenues and a 457 billion budget surplus. 54 rows January 25 2021.

The top 1 would only get 01 of the benefit if the 10000 SALT cap is gradually restored beginning at 400000. According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less. Taxpayers can deduct up to 10000 of their state and local taxes on their federal income tax.

Even those making between 17500 and 250000 would get a tax cut of just over 400 or about 02 percent of after-tax income. By contrast the higher SALT cap would boost after-tax incomes by 12 percent for those making between about 370000 and 870000. Republicans added the cap to reduce the.

How to pay 0 capital gains taxes with a six-figure income. House Democrats pass package with 80000 SALT cap till 2030. Here are must-know changes for the 2021 tax season.

Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation. SALT Cap Confounds House Democrats Crafting Taxes for Biden Plan. As President Joe Biden and policymakers in Congress consider changes in tax policy over the coming year the fate of the 10000 state and local tax SALT deduction cap.

SALT Repeal Just Below 1 Million is Still Costly and Regressive. How Democrats Got Trapped in a SALT Box. The deduction previously unlimited was capped at 10000 as part of the 2017 tax bill which was President Donald J.

As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions SALT is becoming an important part of the tax debate. In the meantime. Kludge democracy might force.

Get an average tax cut of about 20 in 2021 from either proposal largely.

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

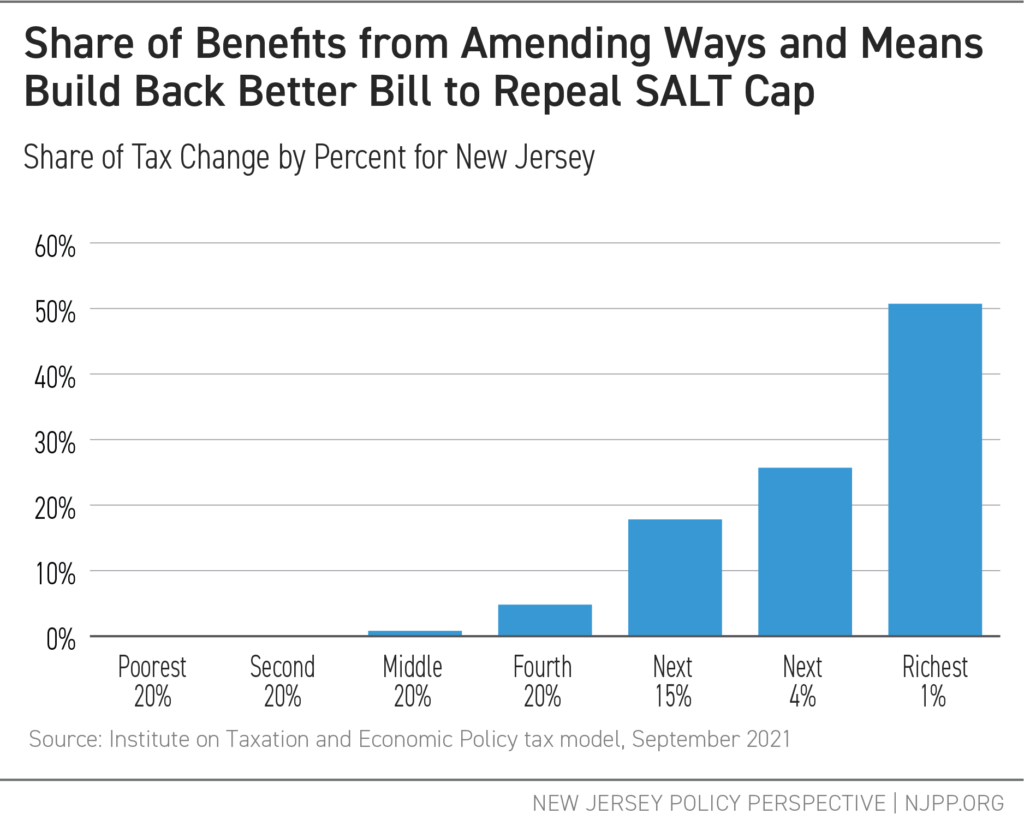

Build Back Better Legislation Makes The Tax Code Fairer But Only If Salt Cap Stays In Place New Jersey Policy Perspective

Dems Demanding Salt Tax Cuts Stand To Benefit

72 500 Salt Cap Is Costly And Regressive Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

How To Deduct State And Local Taxes Above Salt Cap

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Wealthy Americans May Get 10 Times Bigger Tax Cut Than Middle Class Families In Biden Bill

Revenue Neutral Salt Cap Relief Is Costly And Regressive Committee For A Responsible Federal Budget